About Us

About Us

Active Capital Reinsurance, Limited

Active Capital Reinsurance, Limited (Active Re) is a reinsurance company domiciled in Barbados with a General Insurance and Reinsurance License granted by the Financial Services Commission of Barbados (FSC). Active Re's business lines include Property & Engineering, Energy, Credit & Surety, Group Life, Affinity & Bancassurance, Miscellaneous, among others. Thecompany also offers tailor-made alternative risk transfer solutions (ART), including actuarial analysis and risk management advisory services and writes Liability and Financial Lines as well as Marine Cargo through several MGA's.

In August 2024, AM Best affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Rating of "a" (Excellent) for Active Re. The outlook for these credit ratings remains stable. The ratings reflect Active Re's balance sheet strength, which AM Best assesses as strongest, as well as its strong operating performance, neutral business profile and appropriate enterprise risk management (ERM).

Over the last five years, Active Re has reported an annual average Net Reinsurance Premium of US$ 158MM, reflecting consistent growth and robust financial performance. Between 2019 and 2023, the accumulated total premium amounted to US$ 794.0MM, underscoring the high-class financial security offered to clients.

Vision

- Global, specialised & innovative

Mision

- Benefits for all

Values

- Respect

- Integrity

- Confidentiality

- Commitment

- Passion

- Discipline

- Results

STRENGTHS

- Investment grade rating of A (Excellent) AM Best

- International strategic alliances

- Human team

- Dynamism & responsiveness

- Innovative & specialised solutions

- Customer service focused

- Experience & trust

VALUE PROPOSITION

- The best ally for our client

Board of Directors

Executive Chairman

Juan Antonio Niño Pulgar

Secretary

Ramón Martínez Carrera

Independent Director

Carlos García De Paredes

Treasurer

Margarita Niño de De La Rocha

Independent Director

Kyrk Cyrus

Alternate Director

Robert Blair Ali

Alternate Director

Juan Antonio Niño Reategui

Alternate Director

Christian Vergara Oliva

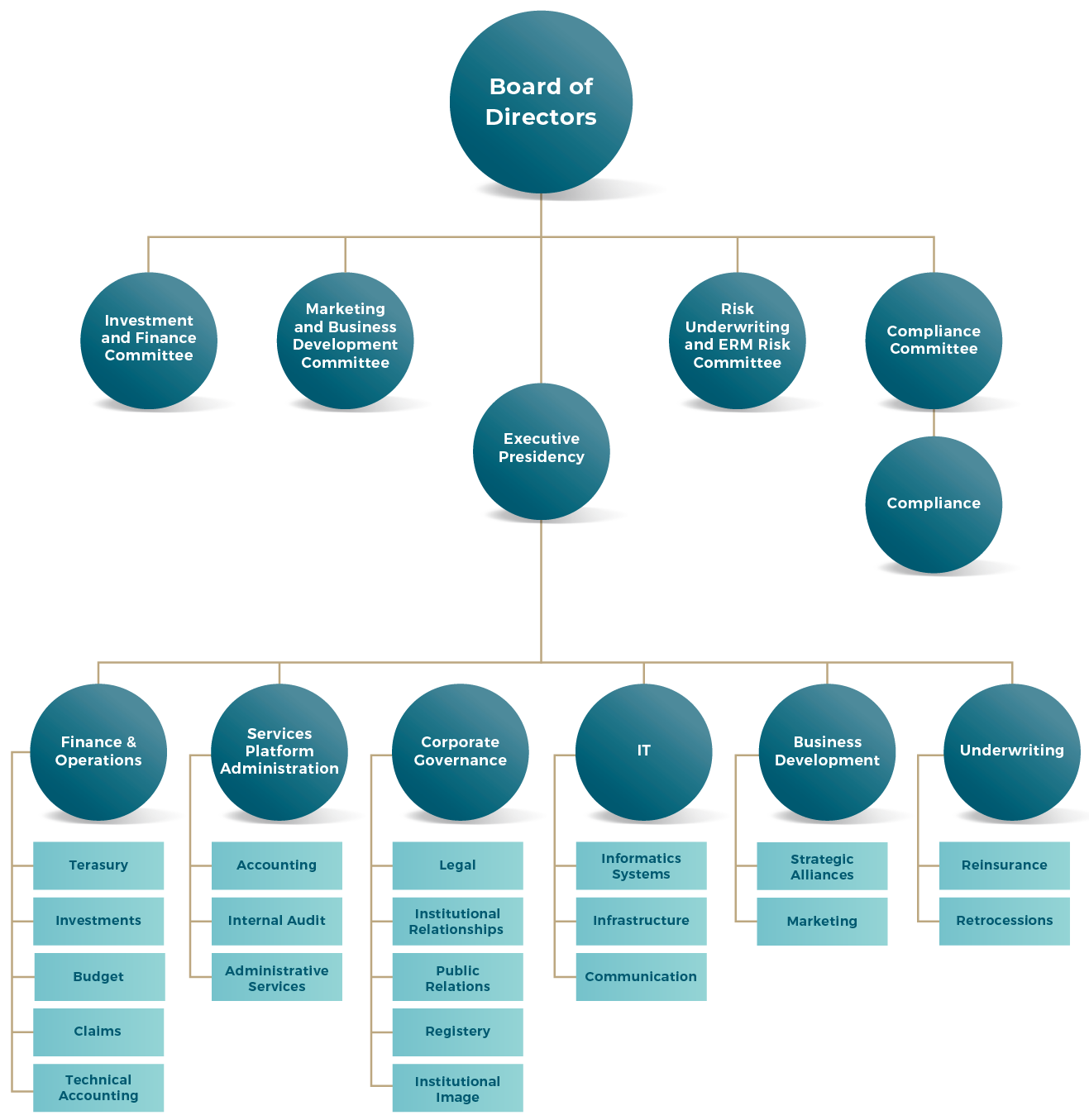

ORGANIZATIONAL STRUCTURE

MGA

Chief Operating Officer

Robert Blair Ali

[email protected]

Delegated Underwriting Authorities Coordinator

Sebastian Barrera

[email protected]

Delegated Underwriter Coordinator

Carla Chiara

[email protected]

Delegated Underwriter Coordinator

Luis Tapia

[email protected]

Delegated Underwriting Authorities Supervisor

Alexandra Cuartin

[email protected]

Reinsurance Claims Analyst

Ryan Thornhill

[email protected]

Reinsurance Portfolio Management Analyst

Lina Jiménez

[email protected]

TREATY

Head of Overseas Treaty Business

Aleksandr Mazhorov

[email protected]

Underwriter Treaty Business

Aleksei Demkin

[email protected]

![]()

![]()

![]()

SURETY & BONDS

Head of Global Credit & Surety Underwriting

Erik Feigelson Johansson

[email protected]

Underwriter Credit & Surety

Javier Jácome

[email protected]

PERSONAL LINES

Head of Personal Lines

Mario Carrillo

[email protected]

Underwriter Personal Lines

Maria Barajas

[email protected]

Underwriter - Personal Lines

Nivine Moussa

[email protected]

Retrocession

Head of Global Retrocession

Marco Silva

[email protected]

Business development

Chief Commercial Officer

Esteban Madero

[email protected]

Business Development Overseas & Manager MENA

John Kotran

[email protected]

Business Development LATAM

Juan Antonio Niño R.

[email protected]

Underwriting

Manager Reinsurance Underwriting

Humberto Riquelme

[email protected]

Underwriter General Lines

Isabel Lam

[email protected]

Senior Underwriter

Daniel Dagnino

[email protected]

Pricing and Modeling Actuary & UW

Miguel Córdoba

[email protected]

Business Development & Underwriting

Maria Tsareva

[email protected]

Underwriter General Lines

Anna Romanova

[email protected]

Underwriter General Lines

Ketty Tomb

[email protected]

Underwriter General Lines

Artem Ushakov

[email protected]

Underwriter

Ekaterina Smirnova

[email protected]